Stablecoins are no longer a crypto niche, they’re turning into a parallel layer of financial infrastructure. As banks fight to protect deposits and policymakers try to define what “digital dollars” are allowed to be, the real contest is shifting to yield, distribution, and control of payment rails.

We spoke with Murtuza Merchant, a blockchain expert focused on digital-assets intelligence and market structure, about where power is moving, and what the next financial system may look like.

What was the moment banks stopped treating stablecoins as a sideshow and started defending deposits as a strategic asset? What changed first: distribution, yield, or regulatory posture?

Murtuza:

For banks, the inflection point wasn’t a single product launch, it was regulatory clarity. As stablecoin-specific legislation and frameworks gained momentum (including proposals like the GENIUS Act), the message to banks was simple: this market is being formalized.

Banks are, by definition, highly regulated entities. Once the rules start to spell out how regulated institutions can issue or participate in stablecoins, the conversation shifts from “crypto experiment” to “competitive financial product.” That’s when banks stop watching from the sidelines and start defending their core advantage: deposits.

In plain terms: how exactly do stablecoins “compete with deposits”? Where is the pressure strongest: payments, savings/yield, cross-border, or treasury rails?

Murtuza:

Banks attract consumer funds by offering interest, then aggregate deposits and lend them out at higher rates. A significant portion of lending supports construction and real-estate projects, where assets can be pledged as collateral. This traditional deposit-and-loan cycle is a critical pillar of economic activity.

Stablecoins change the mechanics in a subtle way.

A useful analogy is the paper check. Historically, you’d deposit cash in a bank and write checks against those funds. With stablecoins, you deposit money with a financial institution and receive an equivalent value in tokens that you can use to settle obligations. The recipient can redeem those tokens for the underlying cash held at the institution.

The institution still earns interest on the underlying funds, but the asset allocation differs. For short-duration flows like payment-like stablecoin balances, institutions tend to place funds in short-term “safe” and liquid instruments (such as Treasuries) rather than bundling them into long-duration lending pools.

Where the pressure concentrates depends on the product design:

-

Payments & settlement: stablecoins remove friction, especially cross-border.

-

Savings/yield: stablecoins become deposit-like when they offer yield.

-

Treasury rails: stablecoins shift flows into short-term government paper rather than bank lending.

A key political and regulatory tension emerges around who is allowed to pay yield. Banks have pushed for frameworks that preserve a distinction between regulated banks and unregulated platforms. The banking argument is that if anyone can offer deposit-like yield without bank-grade obligations, deposits migrate away — reducing funds available for traditional lending. Crypto platforms counter that this is protectionism.

Banks respond with a simple retort: if non-banks want to offer bank-like products, they should accept bank-like obligations. Some crypto firms have pursued banking licenses; others have lobbied against being pulled into the banking perimeter as market-structure legislation develops.

Yield is the flashpoint. Why did stablecoin yield become the political battleground, what do regulators actually fear: consumer harm, runs, or disintermediation?

Murtuza:

Banks fear a structural shift in capital allocation: a flow of funds out of traditional lending and into short-duration Treasury exposure.

Some economists argue banks have a point. Treasuries finance government debt, but they do not necessarily translate into the same kind of productive credit creation as business lending, construction lending, and industrial financing.

Regulators, meanwhile, are balancing multiple fears at once:

-

Consumer harm (misunderstood risks and protections)

-

Run dynamics (fast redemptions at internet speed)

-

Disintermediation (deposits moving outside the traditional banking system)

Yield turns stablecoins from “payments tech” into “deposit competition”, and that’s why it becomes political.

If you had to map the “battlefield,” who are the real distribution kings in 2026: banks, exchanges, fintech wallets, or big merchants? And what’s the moat: compliance, trust, or UX?

Murtuza:

In 2026, real distribution power sits with banks and large exchanges, especially the players operating at the intersection of both. Platforms like Robinhood are a clear example: brokerage infrastructure, crypto access, regulated custody, and a consumer-friendly interface under one roof.

Traditional banks still control fiat on-ramps, payroll relationships, and credit. Exchanges control liquidity, trading infrastructure, and the most active user bases in crypto. When those capabilities converge, the distribution advantage becomes difficult to challenge.

The moat is not just one factor. It’s the compound of:

-

Compliance (the ability to scale without regulatory overhang)

-

Trust (brand recognition and consumer protection frameworks)

-

UX (keeping users engaged and reducing friction when new products launch)

Crypto-native apps may innovate faster, and merchants can drive adoption at checkout, but the platforms that control access, identity, and capital flows tend to win — especially as crypto rails become invisible plumbing.

Which regulatory moves will matter in practice? Name 2–3 rules that will change consumer behavior.

Murtuza:

Redemption parity is likely to be one of the most consequential shifts. If regulated stablecoins are treated as redeemable at par with dollars inside the banking system, the practical distinction between USD and something like USDC collapses for everyday users. Moving between bank deposits and stablecoins becomes frictionless, and the idea of “on-ramping” and “off-ramping” starts to feel obsolete.

Reserve requirements will also materially change behavior. If regulators mandate high-quality, short-duration assets, strict segregation, and robust disclosures, stablecoins begin to resemble narrow banks. That increases confidence, and encourages larger balances to be held in stablecoins beyond trading use-cases.

Finally, KYC and wallet controls are a major lever. Stricter identity rules or restrictions on anonymous transfers would shift usage patterns toward regulated platforms and away from purely permissionless environments. That can improve compliance and institutional adoption, but it also changes who participates and how stablecoins circulate.

From your market-structure lens: what signals do you watch to detect stablecoin stress early?

Murtuza:

Early stress usually shows up in flows and liquidity before it becomes a visible depeg.

One signal is onchain stablecoin movement, especially large and unusual transfers into centralized exchanges. Sudden inflows can indicate hedging, redemption pressure, or major positioning shifts. If flows skew heavily toward one stablecoin, that imbalance can build quietly beneath the surface.

Cross-chain price spreads are another early indicator. When the same stablecoin trades at different prices across networks, it often reflects liquidity fragmentation or localized demand shocks. In normal conditions, arbitrage keeps prices aligned. When spreads widen, it suggests stress in routing or depth.

A recent example came during the $TRUMP token launch, which used USDC as the quote asset. Concentrated demand in USDC pairs created imbalances in thinner USDC/USDT markets. At one point, USDT traded as low as $0.80 in certain pools, creating a large arbitrage opportunity. The issue wasn’t necessarily solvency, it was shallow liquidity reacting to sudden demand shifts.

How does leverage re-accumulate so fast after sell-offs in crypto markets? Where do liquidations turn into systemic risk?

Murtuza:

Leverage rebuilds quickly because crypto is structurally geared toward short-term speculation. After liquidation events, many traders interpret the wipeout as a reset, and re-enter fast, convinced they can time the next move better.

There’s also an incentive layer. Perp DEXs often reward volume through points, rebates, or potential airdrops. Traders may open opposing leveraged positions across different platforms, for example, 20x long on one venue and 20x short on another, to farm rewards. Directional risk is reduced, but open interest still rises.

Liquidations turn systemic when positioning becomes crowded on one side while liquidity thins. Forced selling triggers more forced selling, and the cascade becomes reflexive rather than merely speculative.

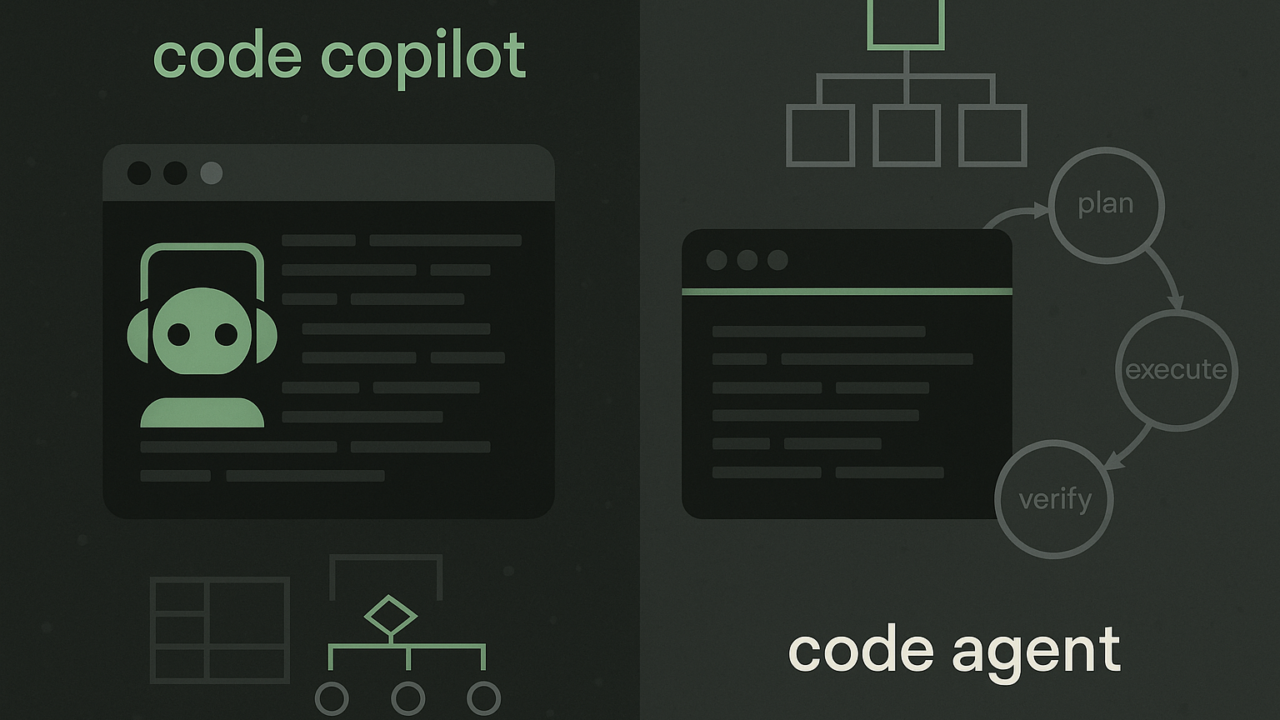

Automation and AI are increasingly part of the plumbing. Where do they genuinely improve market integrity — and where do they amplify fragility?

Murtuza:

A lot of “AI” in crypto is marketing, but automation genuinely helps in surveillance. When contracts are used hundreds of thousands of times per day, humans can’t monitor everything. Automated systems can flag abnormal flows, oracle issues, exploit patterns, and suspicious trading behavior quickly.

Fragility increases when automation drives trading behavior itself. If many participants rely on similar models or liquidation engines, reactions become synchronized. That accelerates cascades and makes volatility sharper, especially when liquidity is thin.

“Web3 is being absorbed into TradFi.” What’s already real infrastructure today, what’s still mostly pilot theater?

Murtuza:

Some parts of “Web3 merging with TradFi” are already real infrastructure. In payments and settlement, stablecoins are the clearest example. USDC shows how crypto rails can deliver faster cross-border settlement and lower transaction costs while still fitting within frameworks that regulated institutions can work with. Banks, fintechs, and payment processors are increasingly integrating stablecoin settlement for treasury and remittance flows. This isn’t just pilot theater, it’s production use.

Tokenized funds and instruments are also moving beyond concept. Products like BlackRock’s BUIDL demonstrate that major asset managers are willing to issue tokenized vehicles onchain. That opens new liquidity pools and access patterns, while custody and compliance tooling matures through regulated custodians and transfer restrictions built into the assets.

What still feels experimental is the retail-facing narrative of fully decentralized stock markets replacing traditional exchanges overnight. Most tokenized products today operate within controlled environments — often permissioned access with traditional compliance layers. The integration is real, but it’s incremental and institutional rather than revolutionary.

Trust is the product. What looks like “trust theater”, and what would be good enough evidence of reliability for a stablecoin/payment rail in 2026?

Murtuza:

“Trust theater” is when transparency looks impressive but lacks enforceability. Dashboards, attestations, and proof-of-reserves reports can help, but they’re often periodic snapshots that still require users to trust a custodian’s word.

Proof of reserves is useful, but reducing trust is better than managing it. Self-custody is the strongest model because users control funds directly and remove counterparty risk, shifting reliance from corporate assurances to cryptographic guarantees.

Another meaningful signal is institutional integration. If established TradFi firms operating under strict regulation are willing to integrate or partner with a stablecoin issuer, that adds credibility.

By 2026, “reliability” should mean transparent reserves, regulated custody, strong liquidity, and minimal dependence on trust-based promises.