AI and ML: Game Changers in Investor-Mentor Matching Systems

AI and ML are the game changers, making financial services more efficient, personalised, and secure. The role these technologies play in the development of investor-mentor matching systems is curious. Let’s discuss it in more depth.

As a former Product Manager at IvyCamp, a startup engagement platform that built a network of over 5k alumni as mentors, investors, and entrepreneurs, I have a diverse perspective on investor-mentor matching platforms, since I was engaged in the Early Stage Investment Platform creation. At the time, IvyCamp’s goal was to find promising startups and identify funding needs and market problems in a 5-year cycle. We built the first platform that allowed large corporate companies to invest in startups. IvyCamp’s platform scraped data from millions of sources to build large ML models that would help understand startups and predict their life cycle. As a result, we shortlisted 50k startups globally for investment.

Scaling the Platform and Reducing Investment Risk

I started as the first Product/Engineering hire and went from an Individual Contributor to managing a hyper-scalable team. After the 6-month MVP, I built a team of 7 highly experienced developers, and under my leadership, we created a hyper-scalable platform. This platform managed the entire $200M fund and housed 50,000+ startups globally. It allowed IvyCamp to reduce its investment risk significantly.

AI-Driven Efficiency and Personalised Matchmaking

AI and machine learning greatly enhance the capabilities of matching through data-driven decisions. For instance, implementing AI-driven algorithms based on predefined criteria such as industry, growth stage, and investment goals simplifies the matchmaking process for startups with suitable investors and mentors. AI tools like Chronus leverage predictive algorithms to make better mentor-mentee matches based on preferences, skills, and experience, resulting in better outcomes.

Predictive analytics builds models to forecast market trends using historical and real-time data, helping financial professionals make appropriate decisions and optimize strategies. AI also tailors individual mentorship experiences, leading to more efficient interactions, higher engagement, and improved satisfaction. AI-driven platforms scale mentorship programs, enabling them to host more participants simultaneously. By automating routine tasks, AI reduces data processing efforts and expenses, allowing financial professionals to focus on strategic activities.

Leveraging ML and NLP for Improved Matching

Moreover, ML algorithms predict successful matches by using investor references, startup profiles, and current market trends. This yields impressive results with targeted recommendations, increasing the likelihood of successful investments. ML continuously analyzes interactions and outcomes to refine matching algorithms, improving program effectiveness. Additionally, natural language processing (NLP) helps process unstructured data, such as startup pitches, investor profiles, or mentor expertise, identifying key attributes, skills, and interests. This results in more accurate matches based on qualitative factors.

Data-Driven Development and Addressing Security Challenges

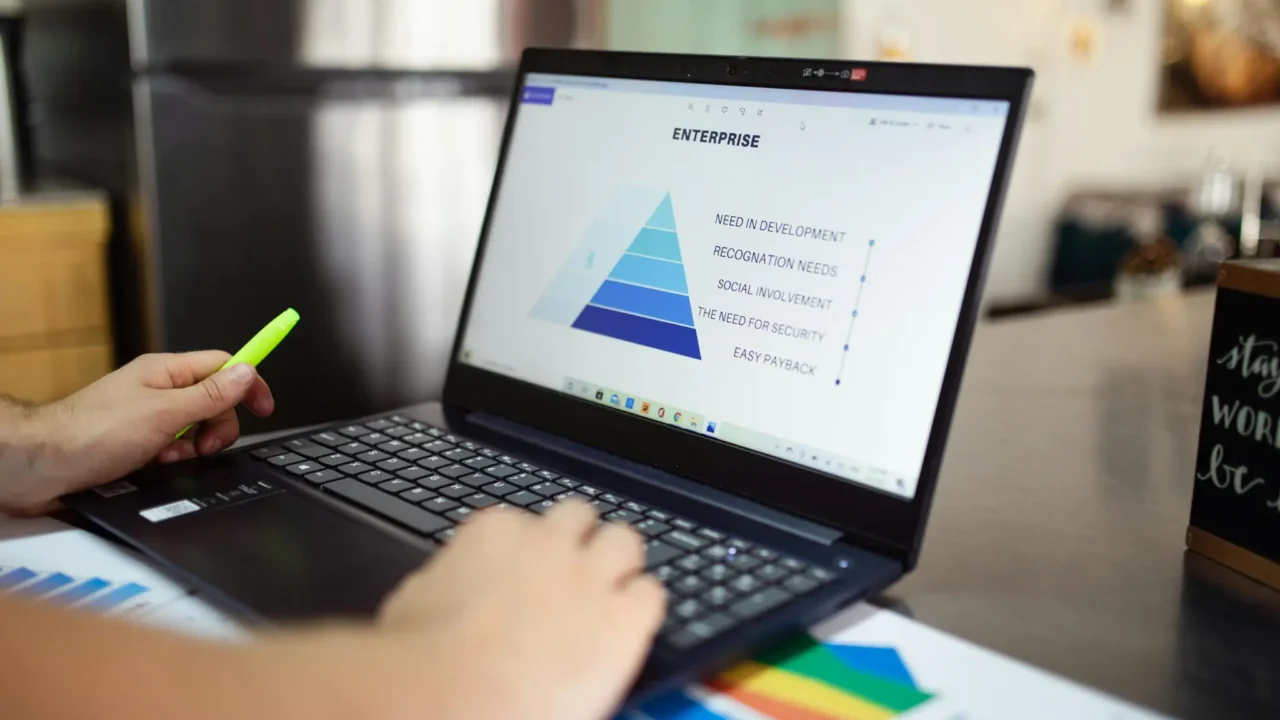

Data-driven development shapes investor-mentor platforms, driving product feature innovation and enhancing user experience. AI enables the creation of individualized, scalable, and efficient mentoring solutions. Metrics like KPIs and OKRs help visualize the impact of this approach. Continuous improvement lies at the heart of the methodology, ensuring platforms remain competitive.

However, challenges such as data security and regulatory compliance remain. Ensuring data accuracy is crucial, starting with data preparation: regular audits, deduplication, and validation processes help maintain a high-quality database of startups, investors, and mentors. AI models depend on clean and refined data for accurate matching. Agile methodologies, including regular sprints and stand-up meetings, are essential for better team collaboration and continuous platform improvement.

Ensuring Data Security and Regulatory Compliance

To mitigate risks, platforms must implement robust encryption and secure user authentication methods. Regular software updates and security audits are crucial in addressing vulnerabilities. Compliance with regulations like GDPR is essential, incorporating the necessary protections for data security. Offering compliance training to mentors and mentees helps cultivate a culture of data security awareness.

The Future of AI-Driven Investor-Mentor Platforms

In conclusion, AI and ML enhance investor-mentor platforms by improving personalization, operational efficiency, and risk management. These technologies enable vast data analysis, automate compliance, and tailor services to specific needs, creating a superior customer experience and fostering greater trust. As the fintech industry evolves, companies looking to gain a competitive advantage and drive sustainable growth must embrace data-driven innovation.